Creators Don’t Need an Emergency Fund

You've heard it a thousand times: save three to six months of expenses for emergencies.

It's the first rule of personal finance. Everyone from your parents to every financial guru on the internet repeats it like gospel.

Here's the problem: that advice assumes you have a regular paycheck. It assumes your income is predictable, stable, and arrives on a schedule you can count on.

If you're a creator—actor, musician, dancer, writer, filmmaker—none of that applies to you.

So no, you don't need an emergency fund.

You need a runway.

The Problem with “Emergency Funds”

An emergency fund is designed for unexpected catastrophes: your car dies, you get laid off, medical bills hit. It’s insurance against bad luck.

That's not what creators need.

Actors, musicians, dancers, writers, painters, filmmakers, founders—your income doesn't follow a W-2 pattern. You're not getting laid off because there's no "off" to get laid from. You're between projects or you're in development. You're auditioning or you're pitching. The work is irregular by design.

What you need is runway: the financial distance between creating from courage and creating from fear.

What A Runway Actually Does

A Runway gives you:

The ability to turn down exploitative contracts

Time to wait for projects that advance your career, not just pay rent

Space to develop work without panic

Leverage in negotiations

The option to say no

It lets you be strategic, not responsive.

When you have 18-24 months of expenses saved, you're not just protected from disaster—you're positioned to take calculated risks. You can invest time in a project that doesn't pay now but builds your reputation. Or you can walk away from a bad deal you would have been forced to take due to financial constraints. A runway provides choice and flexibility.

The Data: Why Creators Need More

I pulled 2024 Bureau of Labor Statistics data on wage variability. Here's what creators are up against:

Actors: Median wage $23.33/hour, but bottom 10% earn under $14/hour while top 10% earn over $97/hour. Annual spread: $173,035.

Musicians/Singers: Median $42.45/hour, ranging from under $19/hour (bottom 10%) to over $105/hour (top 10%). Annual spread: $180,461.

Writers and Authors: Median $72,270/year, ranging from $41,080 (bottom 10%) to $133,680 (top 10%). Annual spread: $92,600.

And that's just for creators with W-2 employment tracked by BLS. Freelancers make up 36% of the U.S. workforce—78.4 million people—and they face even more extreme income variability since they have no salary floor at all.

Creators face structural income volatility. Not because you're bad at what you do—because the work itself is project-based, seasonal, and potentially irregular.

How Much Runway You Actually Need

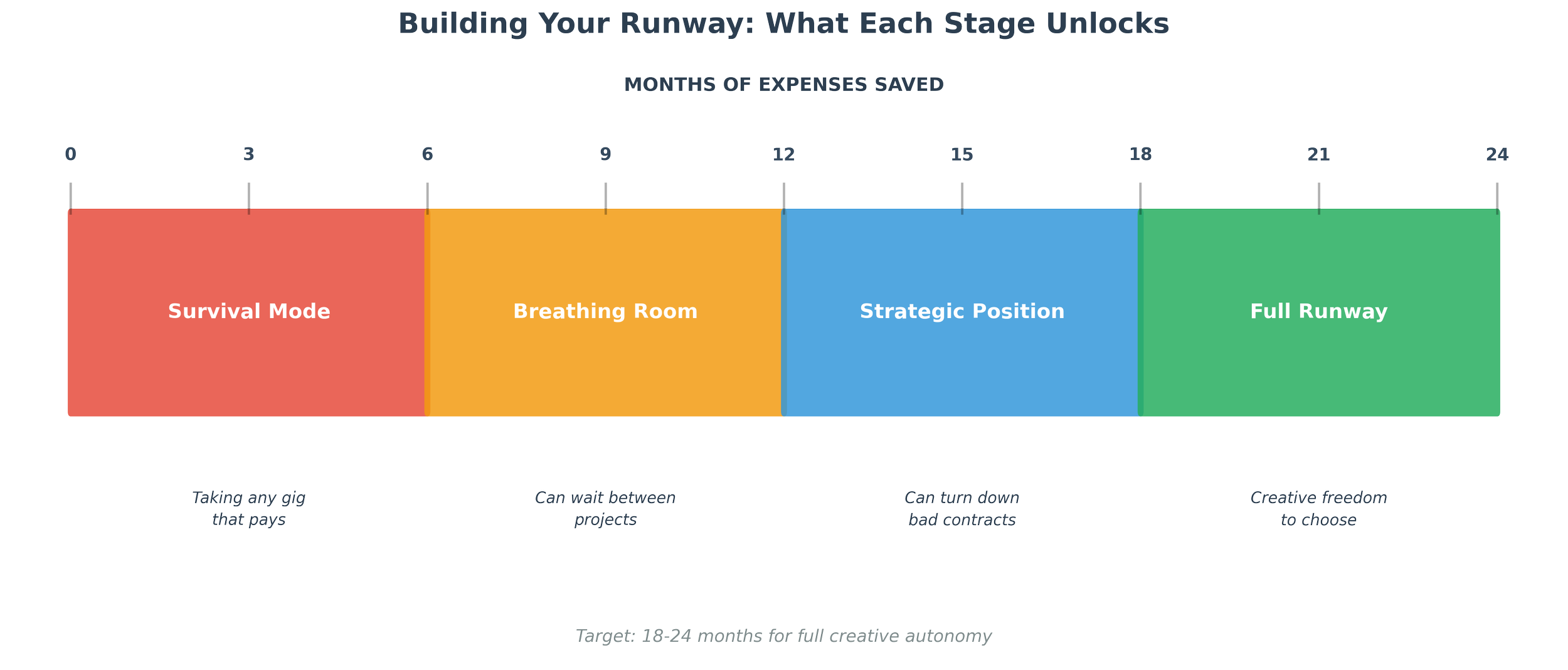

For creators, I recommend 18-24 months of expenses.

I know, I know that sounds impossible. But it’s not impossible—it just takes time and dedication.

Think of it this way: if you have 18 months of runway, you can:

Survive a full year between major bookings without panic

Invest six months developing a project with no immediate income

Walk away from a contract that pays but damages your career

Make decisions based on strategy, not survival

Traditional personal finance treats this amount of cash reserves as excessive. For creators and entrepreneurs, it's baseline professional infrastructure.

How to Build A Runway (The Practical Version)

Step 1: Eliminate high-interest debt

Credit card interest rates will destroy you faster than anything else. If you're carrying balances at 20%+ APR, that's your first target. Kill those balances before you save a dollar.

Step 2: Cut to sustainable minimum

You already know how to live lean. But now you're not doing it because you're broke—you're doing it to buy freedom. Every dollar you don't spend is another day you can say no to bad projects.

Step 3: First milestone—2 months liquid

Open a high-yield savings account at a different bank than your checking. Physical separation matters because willpower doesn't stand a chance against convenience. This money doesn't live where you can easily transfer it for Uber eats. (Yes, I love delivery, too)

Step 4: Triage everything else

Student loans, car payments, personal loans—review them all. Which ones have the highest interest? Which have forgiveness options? Which can you maintain with minimum payments while you build runway? Make strategic decisions, not emotional ones. If this feels overwhelming, find a financial planner who can help.

Step 5: Double-duty your Roth IRA

Once you have 2-4 months liquid, start maxing a Roth IRA (for 2026, $7,500 annually, or $8,600 if you're age 50 or older). Here's why this works: you can pull out your contributions anytime without taxes or penalties. The growth stays locked for retirement, but your principal is available if your wheels fall off. This account serves as both runway extension and retirement infrastructure.

Step 6: Scale up in a taxable brokerage

After maxing the Roth, keep building in a regular brokerage account. But, you don't need to park it in savings—it can be appropriate to invest conservatively instead of leaving it all in cash. Here are a few target allocation funds built for stability and ease: Vanguard LifeStrategy Income (VASIX), iShares Core Conservative Allocation (AOK), or DFA Global Allocation 25/75 (DGTSX). Or you could DIY by holding the assets individually in something like: 25% Vanguard Total World Stock ETF (VT) / 75% Vanguard Total Bond Market ETF (BND), or 25% Avantis Global Equity ETF (AVGE) / 75% Avantis Core Fixed Income ETF (AVIG), to offer a few suggestions. You want enough growth to beat inflation without significant downside risk when you need access.

The Timeline Reality

I won’t sugar-coat it, building 18-24 months of expenses takes time. Even if you're disciplined and aggressive, this could very well be a multi-year project.

That's fine.

You don't build a runway overnight. You start with two months. Then four. Then six. The progress compounds!

The creators who succeed long-term aren't the ones with the most talent (though that helps). They're the ones who build enough runway to outlast the volatility and make decisions from a position of strength instead of desperation.

What Having A Runway Changes

When you have 18 months of expenses saved:

Your agent works for you, not the other way around

You can turn down projects that pay but don't advance your career

You can invest time in development without immediate return

You negotiate from leverage, not need

You choose ideas based on fit, not rent

As a creator, you chose one of the noblest paths on the planet. You can genuinely change lives and inspire the world in ways most can’t even comprehend. But the cost of that privilege is often an uneasy financial road.

If this feels overwhelming, you’re not alone. A good financial planner can help you figure out where to start.